BLACK HILLS CORP /SD/ (BKH)·Q4 2025 Earnings Summary

Black Hills Hits EPS Target, Raises 2026 Guidance 6% as Data Center Pipeline Triples

February 5, 2026 · by Fintool AI Agent

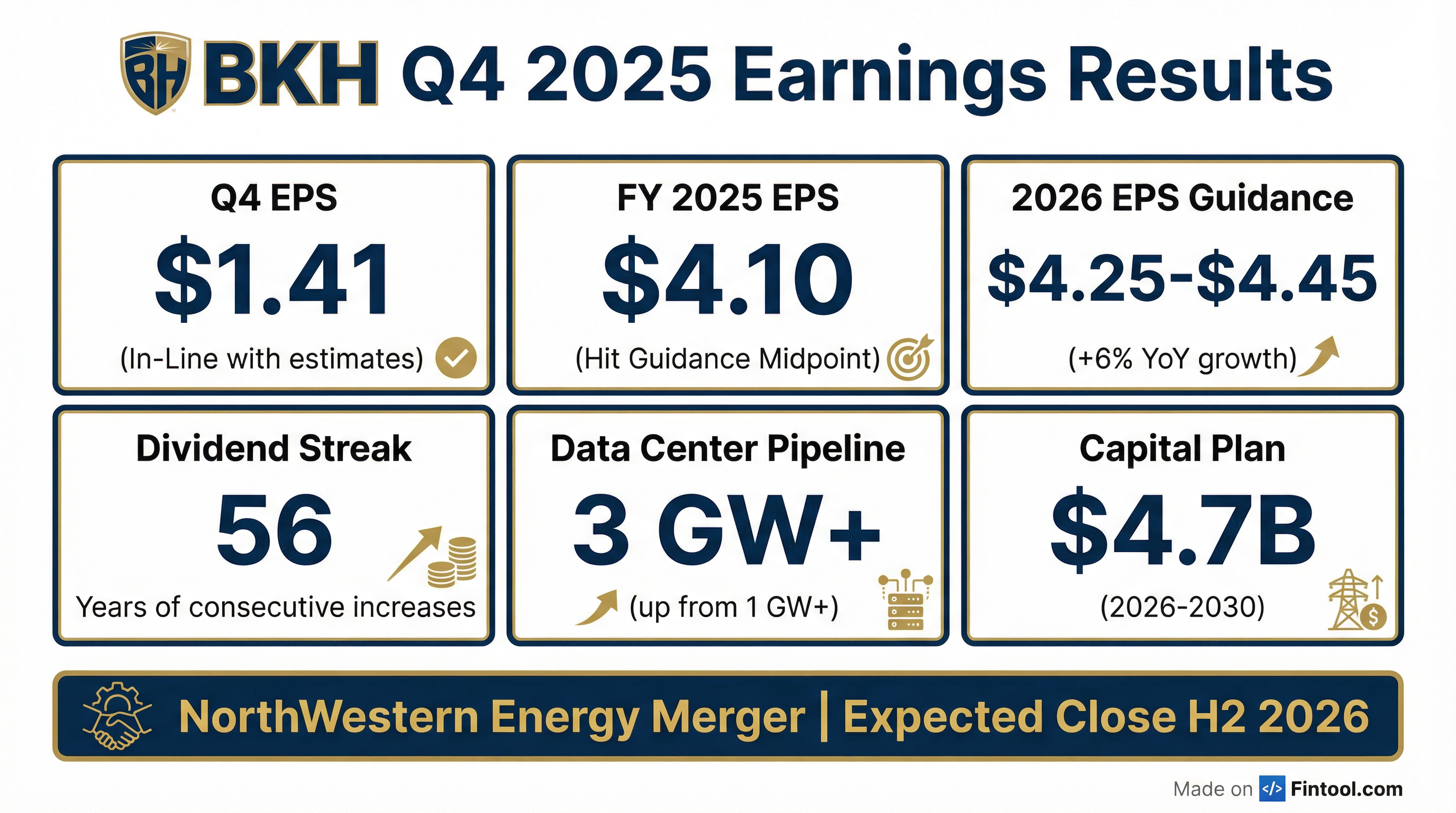

Black Hills Corporation (NYSE: BKH) delivered Q4 2025 adjusted EPS of $1.41, exactly matching consensus estimates and capping a year where the utility hit the midpoint of its earnings guidance. The company raised 2026 EPS guidance to $4.25-$4.45, representing 6% YoY growth, while announcing its data center pipeline has tripled to over 3 GW.

Did Black Hills Beat Earnings?

Black Hills met expectations with Q4 2025 adjusted EPS of $1.41, up from $1.37 in Q4 2024 (+2.9% YoY). Full-year 2025 adjusted EPS of $4.10 landed squarely at the midpoint of the company's $4.00-$4.20 guidance range, with GAAP EPS of $3.98 impacted by $0.12 of merger-related costs.

Key earnings drivers in Q4: New rates and rider recovery contributed $0.25 per share, while weather unfavorability versus normal reduced earnings by $0.07. Interest expense growth and new share issuance created $0.11 of headwinds.

What Did Management Guide?

Black Hills initiated 2026 adjusted EPS guidance of $4.25 to $4.45, with the midpoint representing 6% growth over 2025. Management reiterated confidence in delivering the upper half of its 4-6% long-term EPS CAGR through 2030.

Key 2026 guidance assumptions: Normal weather, constructive regulatory outcomes, 3.5% O&M expense growth, $50-70M equity issuance, and 14% effective tax rate.

What Changed From Last Quarter?

Data Center Pipeline Tripled to 3 GW+

The most significant development was the tripling of Black Hills' data center pipeline from 1 GW+ to 3 GW+. The current plan includes:

- 600 MW of data center load by 2030 with minimal capital investment

- 10%+ of consolidated EPS from data centers beginning in 2028

- Flexible service model with market energy procurement, contracted resources, and utility-owned options

The pipeline represents upside opportunities from negotiations with "high-quality partners" for additional load, investment in generation resources, and transmission expansion.

NorthWestern Energy Merger Progressing

Black Hills filed its S-4/Joint Proxy Statement on January 30, 2026, with shareholder votes scheduled for April 2, 2026. Regulatory applications have been filed with FERC, MPSC, NPSC, and SDPUC.

Merger benefits highlighted:

- Combined rate base of ~$11 billion

- Increased EPS growth target to 5-7% for the combined company

- Serving 2.1 million customers across contiguous jurisdictions

Expected close: H2 2026

How Did the Stock React?

BKH closed at $73.74 on February 4, 2026, trading near its 52-week high of $74.99. The stock has gained approximately 35% from its 52-week low of $54.92, reflecting investor enthusiasm for the data center growth story and pending merger.*

*Values retrieved from S&P Global

Capital Investment & Growth Catalysts

Black Hills reaffirmed its $4.7 billion capital investment plan for 2026-2030, with opportunities for upside from generation and transmission investments to serve additional data center demand.

2025 Achievements:

- Energized Ready Wyoming 260-mile, $350M transmission expansion

- Commenced construction on Lange II 99 MW generation project

- Obtained approval for 50 MW battery project in Colorado (2027 in-service)

- Completed rate reviews in Colorado, Kansas, and Nebraska

2026 Key Initiatives:

- Complete rate reviews for Arkansas Gas and South Dakota Electric

- Complete Lange II generation project in Rapid City

- Obtain regulatory, federal, and shareholder approvals for NorthWestern merger

Dividend Track Record

Black Hills increased its dividend in January 2026, extending its track record to 56 consecutive years of annual increases—one of the longest streaks in the utility sector.

Balance Sheet & Credit Quality

Black Hills maintained its investment-grade credit ratings with stable outlooks from both Moody's (Baa2) and S&P (BBB+).

Forward Catalysts

Near-term (Q1-Q2 2026):

- Shareholder vote on NorthWestern merger (April 2, 2026)

- Arkansas Gas rate review decision

- South Dakota Electric rate review filing

Medium-term (2026-2027):

- Lange II 99 MW generation in-service (Q4 2026)

- 200 MW solar PPA signing (Q1 2026)

- 50 MW battery storage in-service (2027)

- NorthWestern merger close (H2 2026)

Long-term (2027-2030):

- Data center load ramp to 600 MW

- Data centers contributing 10%+ of EPS by 2028

- Potential upside from 3 GW+ data center pipeline

Q&A Highlights

Data Center Pipeline Timing

Analysts pressed for clarity on the 3 GW+ pipeline timeline. CEO Linn Evans explained that the customers "most aggressively" negotiating want to take service in the 2027 timeframe, with load ramping up gradually as they construct and expand data centers.

"The ones that we are negotiating with the most aggressively might be the right phrase... want to take service in that 2027 time frame. And then realize when they start to take service, it will ramp up." — Linn Evans, CEO

Crusoe/Tallgrass Project Update

The Crusoe and Tallgrass partnership represents a significant portion of the pipeline, with agreements in negotiation to support 1.8 GW of demand. Key developments:

- CPCN filed with Wyoming PSC for Robinson substation to support the project

- Fuel cells being evaluated as part of the resource mix

- Unique financing structure where customer would pay for construction to reduce risk to Cheyenne Light customers

- Target: Customer intends to begin taking service in Q1 2027

On the $7 billion of energy infrastructure Tallgrass has publicly discussed investing in the service territory, management noted the resource mix is still being evaluated, with different fee structures applying to market energy, contracted generation, and utility-owned assets.

NorthWestern Merger Discovery Phase

When asked about Montana Commission engagement, Evans confirmed the company is in the discovery phase across all jurisdictions, receiving questions "according to plan" and consistent with expectations.

EPS Contribution Clarification

An analyst confirmed that the 10% EPS contribution from data centers by 2028 is included within the 4-6% EPS CAGR target—not additive to it.

Operational Resilience & Wildfire Mitigation

Extreme Weather Response

The company highlighted its operational resilience during an extreme wind event in December with winds reaching 100 mph in Rapid City, South Dakota. Teams and mutual aid partners replaced damaged poles and lines to restore power safely.

Wildfire Risk Management

Black Hills has established multiple layers of wildfire protection:

- Emergency public safety power shutoff program established as an additional mitigation tool

- Wyoming: Wildfire liability legislation signed into law in early 2025; mitigation plan filed in November with commission approval expected in March 2026

- South Dakota: Supporting similar wildfire legislation

Meta Data Center Update

Meta's AI data center under construction in Cheyenne is expected to transition from construction power to permanent service this quarter (Q1 2026). Combined with Microsoft's ongoing demand growth, the 600 MW of data center load by 2030 is well-supported by existing customer relationships.

Bottom Line

Black Hills delivered a clean quarter with no surprises—hitting EPS targets, raising 2026 guidance, and demonstrating execution on its strategic initiatives. The tripling of the data center pipeline to 3 GW+ adds optionality to the growth story, while the pending NorthWestern merger could accelerate the combined company's EPS growth to 5-7%.

The earnings call provided important clarity on timing: the most advanced data center negotiations target Q1 2027 service commencement, with the Crusoe/Tallgrass 1.8 GW project filing its first CPCNs. With the stock trading near 52-week highs and yielding approximately 4%, valuation reflects much of the good news. The key questions for 2026 are merger execution in Montana, converting data center pipeline into binding contracts, and demonstrating the unique Wyoming tariff model at scale.

Related: BKH Company Profile | Q3 2025 Earnings | Earnings Transcript